what is a provisional tax code

0 if youre married filing a separate return and lived with your spouse at any time during the tax year. You pay it in instalments during the year instead of a lump sum at the end of the year.

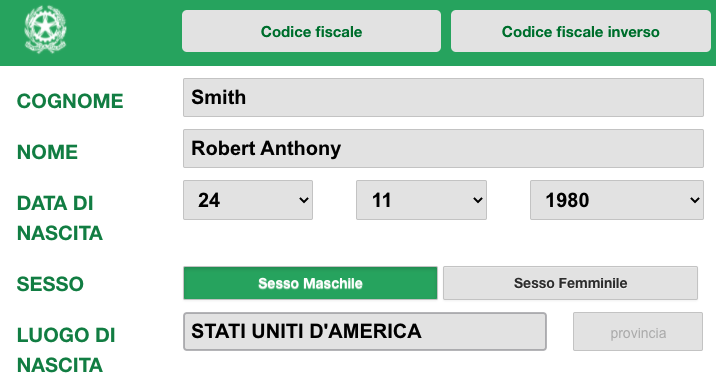

Why You Need A Codice Fiscale In Italy And How To Get One Now

Provisional income calculations can get a bit complex though it is all laid out in 86 of the Internal Revenue Code IRC.

. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on assessment. Natural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1. Provisional tax helps you manage your income tax.

Provisional tax payers need to submit a total of three returns annually. GAP GST and provisional tax payments for Goods and services tax GST and provisional tax return - GST103 filers. Provisional tax is not a separate tax.

It requires the taxpayers to pay at least two amounts in advance during the year of assessment which is based on estimated taxable income. Your income tax return will calculate your tax responsibility based on your actual earnings and is submitted once a year. In certain contexts the term tax code is used to refer to a codethat is a series of numbers and lettersthat has some significance for indirect tax payroll tax or other tax purposes.

It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of assessment. Its payable the following year after your tax return. Provisional taxpayers calculate their provisional tax.

They go towards the tax payable on income with no tax credits attached. Youll pay tax on whichever amount is smaller. Critics argue that the tax break is just like any other fee and should be treated as such.

As defined in paragraph 1 of the Fourth Schedule of the Income Tax Act No 58 of 1962. The provisional tax is actually the payment in advance of this years income tax. Provisional tax is a way of paying your income tax in instalments during the year.

Provisional tax allows the tax liability to be spread over the relevant year of assessment. This is an ITR12 return. Two are provisional tax returns that estimate your earnings for the next 6 months.

Heres a list of the codes to use for different tax or account types. Person who is told by the Commissioner that. 2500 before the 2020 return.

Amounts that you must pay under the provisional tax rules Amounts you choose to pay as voluntary payments to mitigate. The preferred tax treatment has been long battled over by lawmakers and those in the industry. INC Payments for income tax and provisional tax.

Provisional taxes are tax payments made throughout an income year. Provisional tax helps you manage your income tax. Treasury regulations 26 CFR--commonly referred to as Federal tax regulations-- pick up where the Internal Revenue Code IRC.

Treasury regulations 26 CFR--commonly referred to as Federal tax regulations-- pick up where the Internal Revenue Code IRC leaves off by providing the official interpretation of the IRC by the US. A tax code is a unified set of laws that provide the statutory basis for all tax systems within a nation or other jurisdiction. Provisional income is an amount used to determine if social security benefits are taxable.

Treasury regulations 26 CFR--commonly referred to as Federal tax regulations-- pick up where the Internal Revenue Code IRC leaves off by providing the official interpretation of the IRC by the US. If you are a provisional taxpayer it is important that you make adequate provisional. Provisional tax payments can be made up of.

Department of the Treasury. Prior to 1983 social security benefits were not subject to income tax. A third payment is optional after the end of the tax year but before the issuing of the assessment by SARS.

Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return. Emergency tax codes Tell HMRC about a change in income Overview Your tax code is used by your employer or pension provider to work out how. Provisional income is an amount used to determine if social security benefits are taxable.

Income Tax Treatment of Social Security Benefits The income tax treatment of social security benefits is governed by section 86 of the Internal Revenue Code the Code. These are known as IRP6 returns. Inland Revenue take the terminal tax figure and add 5 to it this is your provisional tax amount to pay and is usually due in 3 instalments during your second year.

Tax on 80 of actual taxable income R1 280 000 R412 611. The assessment and the payment of the 1 st installment can be created via Tax Portal. 2500 before the 2020 return.

Its payable the following year after your tax return. It requires the taxpayers to pay at least two amounts in advance during the year. Its like paying as you go rather than paying in arrears.

Treasury Tax Regulations. It requires the taxpayers to pay at least two amounts in advance during the year of assessment which are based on estimated taxable income. 1 The base from 86 of the Internal Revenue Code IRC triggers the taxability of social security.

It is paid by two equal installments on the 31st of July and 31st of December of each year in two equal installments for the given year. Any person that is receiving income other than salary is a provisional tax payer. GST payments for Goods and services tax GST return - GST101A filers.

What is provisional tax. Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return. 2 If your provisional income exceeds these thresholds youll compare 50 of your benefits amount to 50 of your provisional income that exceeds the threshold.

When your financial accounts and tax returns are prepared for 31 March 2021 all that provisional tax youve. IED For intermediaries payroll providers paying employee deductions. The first provisional tax return must be submitted within the first 6 months of the year and the second provisional tax return at the end of the year of assessment.

After clicking through the exit link below select the applicable year select 26.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Aayakar Seva Kendras Ask Be Made As A Transaction Centre Http Taxguru In Income Tax Aayakar Seva Kendras Ask Be Mad Income Tax Indirect Tax Corporate Law

Intellectual Property Firms How To Protect Intellectual Property Provisional Patent Application Intellectual Pro Invention Patent Inventions Financial Literacy

How To Get The Italian Tax Code Codice Fiscale Yesmilano

Step By Step Document For Withholding Tax Configuration Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

W9 Forms 2021 Printable Irs Tax Forms Irs Forms Irs

Step By Step Document For Withholding Tax Configuration Sap Blogs

Getting Your Tax Code Erasmus Blog Milan Italy

Image Result For Gst Format Delivery Challan Invoicing Banking Institution Goods And Services

Why Your Business Needs Help Understanding The Tax Code Legalzoom Com

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return Income Tax Return How To Find Out Business Tax

Tax Code Inps Insurance Coverage Health Care Scuolanormalesuperiore

Step By Step Document For Withholding Tax Configuration Sap Blogs

Best Startup Solutions Company Registration In India Complypartner Start Up Startup Company Digital Marketing Services

3 21 3 Individual Income Tax Returns Internal Revenue Service

Step By Step Document For Withholding Tax Configuration Sap Blogs